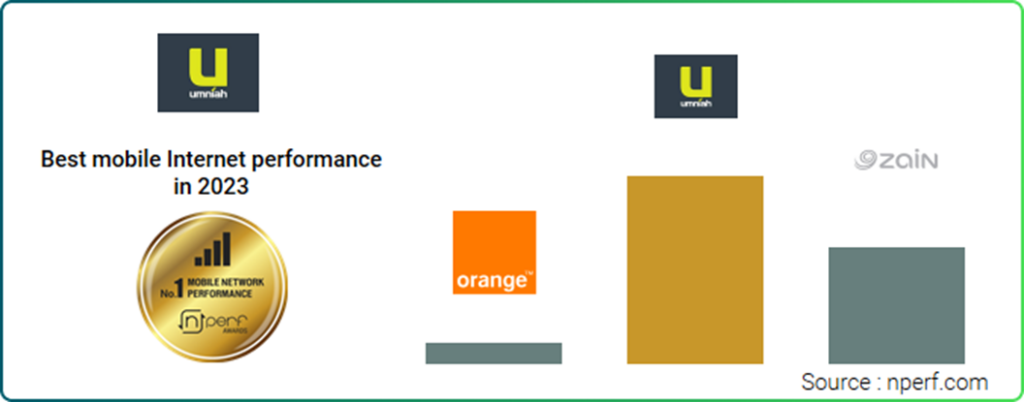

The subscribers of Umniah enjoyed the best mobile Internet performances in Jordan during 2023.

In the context of the mobile Internet market in Jordan, we analyze the performance of leading ISPs, including Orange, Umniah, and Zain. By evaluating key metrics such as download and upload bitrates, latency, web browsing success rates, YouTube streaming quality, and overall nPerf scores, we can determine each ISP’s effectiveness in providing high-quality mobile internet services, which are crucial for a seamless user experience.

Umniah: Mobile market leader

Umniah stands out as the leader in the mobile internet market in Jordan with an impressive nPerf score of 51,067 nPoints. It offers the highest download bitrate at 16.42 Mb/s and an upload bitrate of 11.74 Mb/s, ensuring robust performance for a variety of mobile online activities. With a latency of 54.97 ms, Umniah offers a relatively responsive service. The ISP also leads in user experience metrics, with a web browsing scores of 51.87% and a YouTube streaming scores of 77.13%, highlighting its strong ability to efficiently deliver content to mobile devices.

Zain: A Strong contender with balanced offerings

Zain secures the second position with a solid nPerf score of 43,037 nPoints. It provides a download bitrate of 9.49 Mb/s and an upload bitrate of 8.2 Mb/s, catering well to standard mobile internet usage. The latency of 53.93 ms indicates a comparably responsive service, essential for mobile users. Zain’s web browsing scores of 49.77% and YouTube streaming scores of 76.65% demonstrate its ability to offer a reliable service for media consumption on mobile devices.

Orange: Potential for improvement

Orange ranks third with an nPerf score of 32,443 nPoints, suggesting areas for enhancement. It has the lowest download and upload bitrates at 6.71 Mb/ s and 4.49 Mb/s respectively, which may impact performance during data- intensive mobile tasks. The highest latency of 64.3 ms among the ISPs could affect the responsiveness and smoothness of mobile internet services. Furthermore, Orange’s web browsing scores of 45.06% and YouTube streaming scores of 71.51% are the lowest, indicating room for improvement in mobile content delivery.

Conclusion

The analysis of Jordan’s mobile internet market reveals a competitive arena where ISPs like Umniah, Zain, and Orange each play distinct roles. Umniah leads with the highest overall nPerf score, showcasing superior performance in download and upload speeds as well as in user experience metrics, making it a top choice for mobile internet users. Zain offers balanced services with competitive media consumption capabilities, while Orange, despite trailing in key performance metrics, has opportunities to bolster its mobile internet services to better meet user expectations. This assessment emphasizes the need for a comprehensive approach in evaluating mobile ISPs, considering a range of performance metrics to understand their impact on the quality of mobile internet service and the overall user experience.

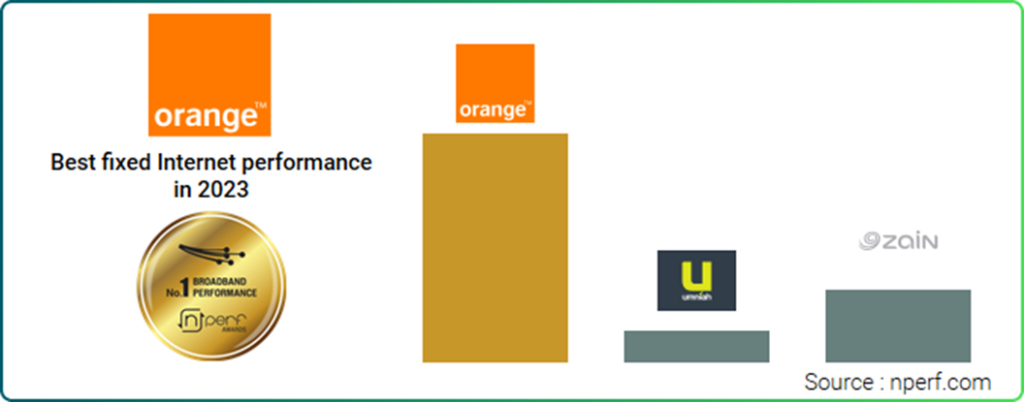

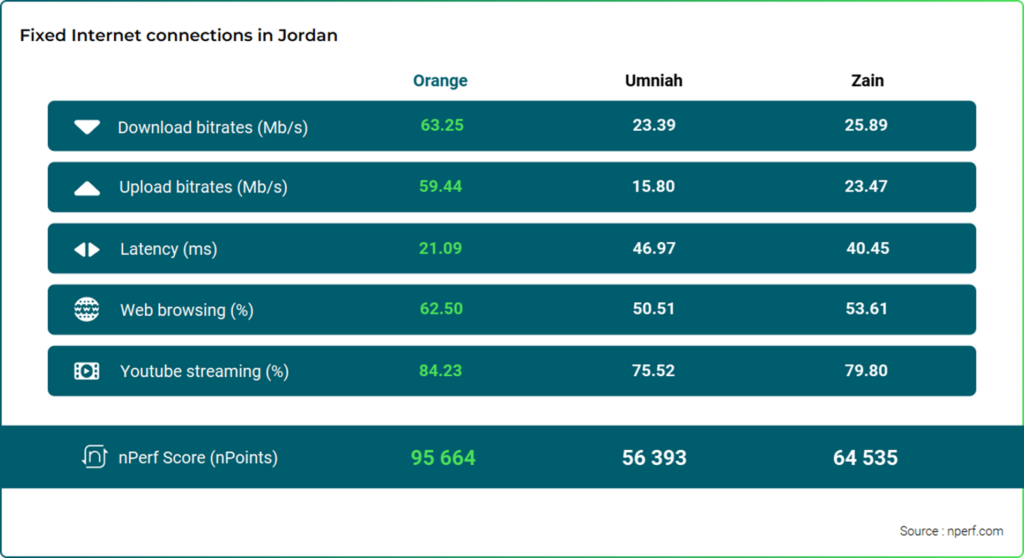

The subscribers of Orange enjoyed the best broadband performances in Jordan during 2023.

In the dynamic fixed Internet market of Jordan, the performance of Internet Service Providers (ISPs) such as Orange, Umniah, and Zain is critical in defining the user experience. Through an in-depth analysis focused on key metrics like download and upload bitrates, latency, web browsing scores, YouTube streaming scores, and overall nPerf scores, we aim to unravel the capabilities of these ISPs in delivering superior fixed Internet services. This evaluation not only highlights the current service levels but also provides insights into potential areas for enhancement, contributing to the broader narrative of digital connectivity in Jordan.

Orange: Setting the standard

Orange leads the fixed Internet sector in Jordan with an outstanding nPerf score of 95,664 nPoints, distinguished by its high download and upload bitrates of 63.25 Mb/s and 59.44 Mb/s respectively. These scores are crucial for bandwidth-intensive activities, ensuring a smooth and efficient online experience. Orange’s latency is commendably low at 21.09 ms, contributing to a responsive service. Moreover, its web browsing and YouTube streaming scores of 62.5 and 84.23 respectively underscore its ability to deliver content effectively, making it a top choice for users seeking quality and reliability.

Zain: A Competent challenger

Zain holds a strong position with a nPerf score of 64,535 nPoints. It offers competitive download and upload bitrates of 25.89 Mb/s and 23.47 Mb/s respectively, suitable for a variety of online activities. With a latency of 40.45 ms, Zain ensures a reasonably responsive Internet experience. The ISP’s web browsing and YouTube streaming scores stand at 53.61 and 79.8 respectively, demonstrating its capability to offer reliable service for media consumption and general Internet use.

Umniah: Room for growth

Umniah, with an nPerf score of 56,393 nPoints, shows potential for growth. Its download and upload bitrates are at 23.39 Mb/s and 15.8 Mb/s respectively, which may affect performance in demanding online tasks. The highest latency among the ISPs at 46.97 ms might impact the smoothness of the service.

However, Umniah’s web browsing and YouTube streaming scores of 50.51 and 75.52 highlight its ability to provide satisfactory service, albeit with opportunities for enhancement to meet user expectations better.

Conclusion

The analysis of Jordan’s fixed Internet market reveals a competitive landscape where ISPs like Orange, Zain, and Umniah each contribute to the service ecosystem with varying levels of quality. Orange stands out with the highest overall nPerf score, reflecting superior performance across all evaluated metrics, particularly in download and upload speeds as well as in web browsing and streaming scores. Zain maintains a strong presence with competitive offerings, especially in media consumption, while Umniah, despite its current standings, holds potential for service improvement. This comprehensive evaluation emphasizes the need for a multifaceted approach to assessing ISPs, considering a broad spectrum of performance metrics to gauge their impact on the quality of fixed Internet service and the overall user experience.